PAY RAISES

State 10% ed raise is earned and affordable

TEA is advocating for a 10% salary increase for all K-12 employees for the 2023-2024 school year. TEA estimates the cost of the raise covering most certified personnel at $270 million, with an additional $50 million for other education employees, including administrators and support professionals.

Advocating for state raises and then working to drive those new dollars into paychecks has been a long-term focus of TEA members. From passing laws to increase the state minimum salary schedule to improving the concentration of state K-12 dollars toward salaries, the work of improving professional pay never stops.

In the upcoming legislative session, there are new opportunities to ensure state funds go into educator paychecks.

The new education funding formula, TISA, has stronger salary earmark language than the previous state education formula, the BEP. Provisions in the TISA law provide the General Assembly the power to direct some or all new salary funding to go to paychecks of teachers who work with students.

Any new salary earmarks for teachers trigger an automatic increase in the state minimum salary schedule. Large and consistent increases in the state minimum have been a key goal of TEA, resulting in improving pay of most rural teachers, putting upward pressure on local salary schedules and raising starting salaries statewide.

LOWER PREMIUMS

Educators pay more than state employees and that must change

Tennessee can afford to bring its support for educator insurance up to par with state employees. Tennessee educators pay a lot more for health insurance than state employees, at a time when the state hoards billions in state budget surpluses.

“TEA is pushing to improve state support for educator insurance by pushing for equity between state employees and educators,” said TEA President Tanya Coats.

“Additional state funding for insurance will drive down premium costs for most educators, and the influx of new state dollars could improve take-home pay for all Tennessee teachers.”

State employees and many educators get insurance coverage from the State Group Insurance Plan (SGIP). Benefits and plan choices of the SGIP are similar for each group, yet premium costs paid by employees are radically higher for educators.

The Tennessee state budget funds 80% of state employee health insurance costs—employees never pay more than 20% of the total premium for the plan they choose. The state funds only 45% of teacher health insurance costs, and even less for support professionals. When local governments cannot make up the difference, costs are shifted directly onto education employees, costing thousands of dollars in premiums each year, especially for family coverage.

“TEA laid the groundwork in 2022 telling legislators that Tennessee teachers shouldn’t pay more than state employees for insurance coverage,” Coats said. “That message resonated and has us poised to correct this inequity this legislative session.”

The bill’s estimated state cost increase was $374 million. TEA pointed out to state leaders that the sum is already being paid in part by Tennessee educators straight from their paychecks.

There is a growing understanding that educator insurance needs to be fixed, especially because state revenue far exceeded earlier projections.

To put $374 million in additional recurring state funding in perspective, the last fiscal year (ending June 30, 2022) saw Tennessee with a budget surplus of more than $5 billion. Had the bill equalizing educator and state employee funding passed, it would have had only a marginal impact on the state budget surplus. Since July 1, Tennessee has collected $742.7 million more in revenue than budgeted, and is on track to run a surplus of more than $2.2 billion for this fiscal year.

“Budgeting $374 million in recurring state revenue would be a historic and much needed increase,” Coats said. “We know our state prides itself on fiscal conservatism, but the record revenues clearly show this is a choice between being fair to the hard-working educators and looking plain stingy.”

Investment, not surpluses

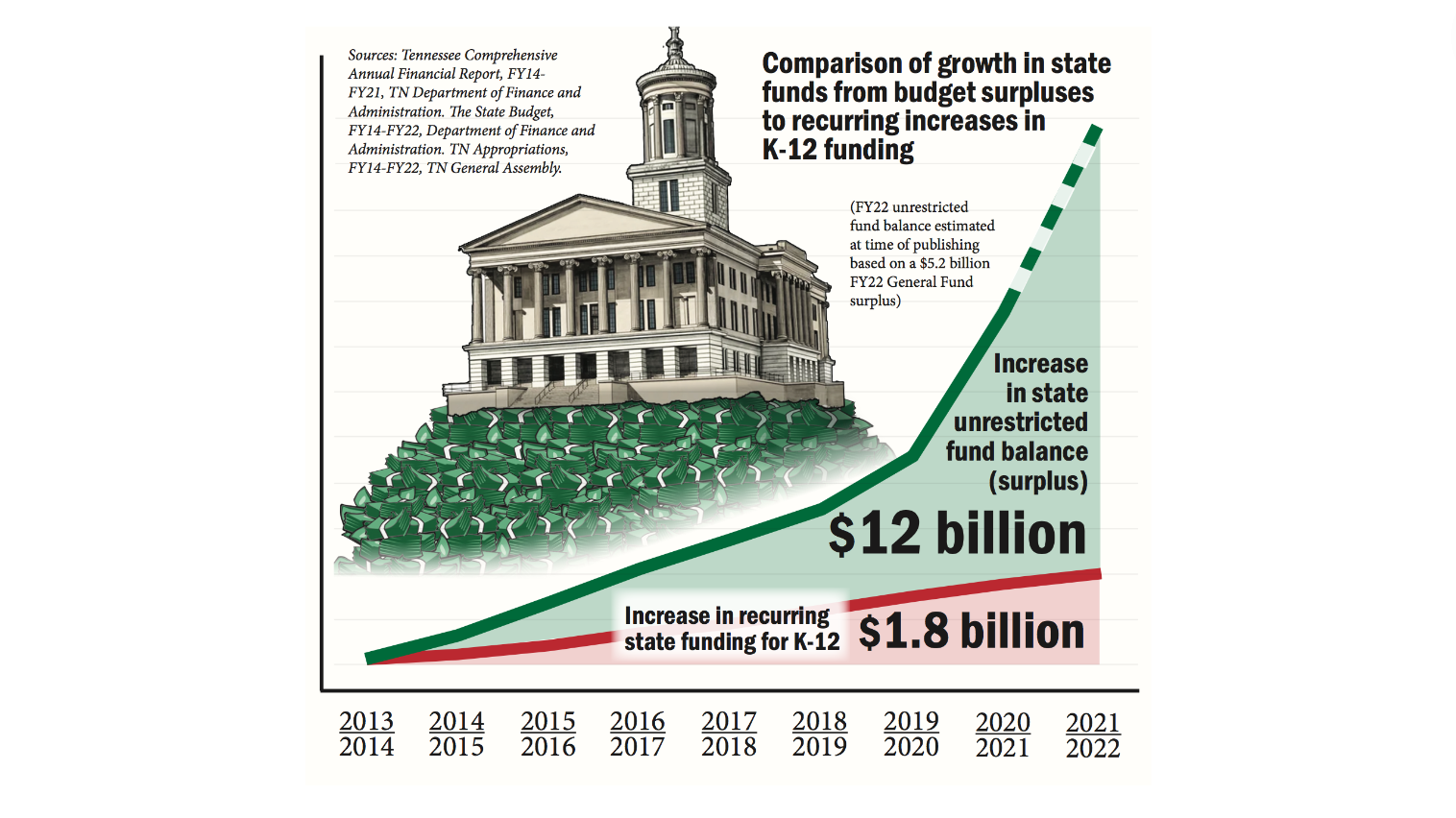

For a decade, Tennessee has run an annual surplus in the state General Fund, the portion of the budget that funds K-12 and other items such as health care and public safety. The last several years have seen state surpluses reach historic levels while Tennessee remains near the bottom nationally in funding per student.

Last year’s state budget surplus — more than $5 billion — almost matched the state’s entire funding for K-12. There is real need to get Tennessee education out of the bottom in funding, and with the state economy booming and state coffers overflowing, there is ample revenue to finally do it.

Our state is fiscally conservative, limiting recurring spending by using low-ball revenue estimates while paying cash for things like roads and future retirement benefits. While this fiscal culture is great for things like TCRS — rated one of the strongest pension systems in the nation — the drive to limit recurring appropriations for K-12 hurts students, schools and educators.

It is a fact that in the last decade more money has been put into the proverbial state mattress than in public school classrooms. That trend can and must stop this legislative session.

The new state dollars needed are readily available to achieve professional pay and affordable health benefits, and more assistance in the classroom. After last year’s $5 billion surplus, the state is currently on track to have a $2.2 billion surplus.